The enactment of the One Big Beautiful Bill Act (OBBBA) has made noticeable waves through the mid-year tax landscape, prompting both businesses and individuals to revisit their financial forecasts. With changes to deductions, credits, and withholding structures, the OBBBA has altered how taxpayers should approach their mid-year tax projections and adjustments. In this blog, we will break down how the OBBBA reshapes tax strategies, what it means for your current year filings, and what adjustments may be necessary to stay compliant and financially optimized in the future.

Stay in the Know

THIS IS THE FIRST IN A SERIES OF RESOURCES WE ARE DEVELOPING TO HELP OUR COMMUNITY BETTER UNDERSTAND THE IMPACT OF THE OBBBA ON THEIR FAMILIES & BUSINESSES

Enter your name and email address to receive OBBBA updates via email.

Thank you!

You have successfully joined our subscriber list.

Key Individual Tax Changes: What’s Already in Effect for 2025

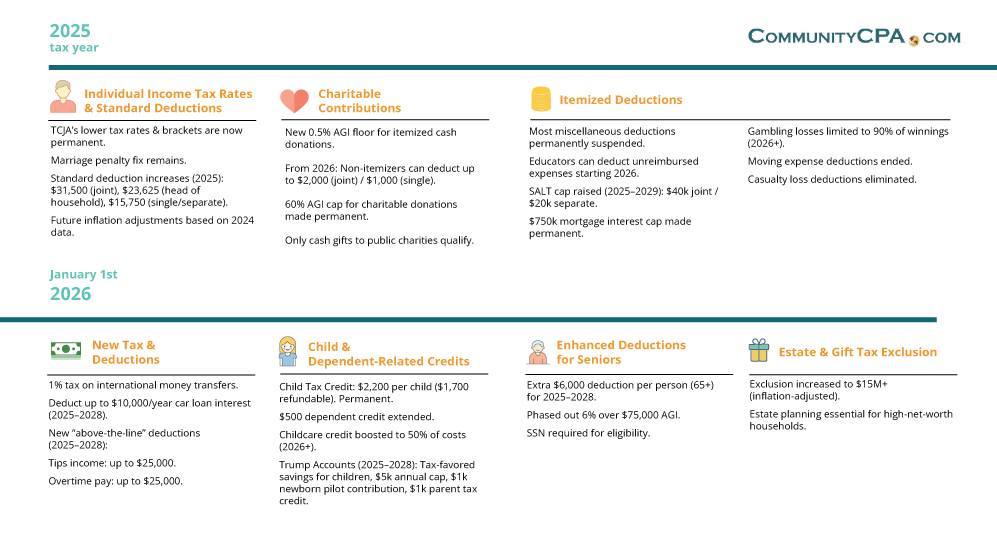

- Tax Rate and Standard Deduction Adjustments: The OBBA permanently extends the 2017 Tax Cuts and Jobs Act (TCJA) tax rates and brackets, which will avoid the anticipated increase. Additionally, the standard deduction for 2025 is raised to $31,500 for couples filing together and $15,750 for single filers. This means that withholdings and estimated tax payments should be re-evaluated to avoid underpayment penalties or overpaying unnecessarily (which is sometimes a good strategy for tax saving).

- New Deductions for Tips and Overtime: For tax years 2025 through 2028, the OBBBA introduces federal income tax deductions where workers can deduct up to $25,000 in qualified tip income, and $12,500 in qualified pay. This is available regardless of whether an individual itemizes or takes the standard deduction. Employers and payroll departments will need to update systems and educate employees on how to properly track and report qualifying income.

- Expanded Child Tax Credit: The Child Tax Credit increases to $2,200 per child in 2025. Families should review their withholdings as this change may affect overall tax liability and cash flow.

- Additional Deduction for Seniors: Taxpayers aged 65 or older can claim a temporary $6,000 annual deduction through 2028.

- Partially Refundable Adoption Credit: The adoption tax credit has been modified to allow for up to $5,000 to be refundable.

Key Business Tax Updates: Opportunities to Act Now

Changes introduced by the OBBBA will affect both itemizers and non-itemizers:

- 100% Bonus Depreciation Restored (Retroactive): The OBBBA restores 100% bonus depreciation which will allow businesses to immediately expense the full cost of qualifying new and used assets. Notably, this change is retroactive to years beginning after December 31, 2021. Businesses may be eligible to amend prior returns to take advantage of accelerated deductions.

- Research & Development Expensing is Back: Businesses can now immediately expense certain research and development costs which were incurred between December 31, 2021 and January 1, 2025. Taxpayers can accelerate deductions over one or two years, depending on filing strategy. This change may be a good prompt for R&D heavy firms to revisit prior-year filings and justify amended returns.

- Business Interest Deductions: The OBBBA reverts the limitation on business interest deductions back to the EBITDA standard, which makes it a lot easier for capital-intensive businesses to deduct more of their interest expense.

- Increased Section 179 Limits: This will enable businesses to fully deduct the cost of qualifying equipment and/or software purchased or financed during the tax year.

Impact on Mid-Year Tax Projections and Adjustments

The enactment of the OBBBA has elevated the importance of mid-year tax projections to an unprecedented level. From implementing payroll adjustments to reassessing tax planning for investments and financial strategies, the scope and complexity of the Act require both timely action and meticulous attention to detail. Here are a few points of impact that may affect you:

- Immediate Review of Withholdings/Estimated Taxes: Both businesses and individuals should immediately review their current tax withholdings, and estimated tax payments, to ensure they make sense with the new tax law provisions. Changes such as extended tax brackets and increased deductions could mean adjustments are needed to avoid penalties or cash flow issues.

- Financial Planning Updates: The OBBBA brings permanent extensions to the Tax Cuts & Jobs Act (TCJA) tax rates, and updates to the State and Local Tax (SALT) deduction cap, along with changes to estate planning thresholds. With this, financial advisors and tax professionals should revisit retirement strategies, tax planning for investments allocation, and long-term estate plans.

- Payroll System Updates: For employers, the introduction of new deductions for tips and overtime means that payroll systems must be updated to accurately calculate federal and tax withholdings. HR and finance teams should work closely with tax professionals to roll out these changes and communicate clearly to impacted employees.

- Business Strategy Reassessment: The restoration of 100% bonus depreciation, immediate Research & Development expensing, and increased Section 179 limits allows more flexibility for businesses and incentives for growth. However, these also require reassessment of capital expenditure plans, R&D budgeting, and overall tax strategies.

- Potential for Amended Returns: For businesses, the retroactive restoration of bonus depreciation and R&D expensing, may create an opportunity to amend previously filed returns going back to the 2022 tax year. This could result in significant tax refunds or offsetting of carryforwards, so it is worth reviewing past filings for these tax saving options.

Businesses and individuals are strongly encouraged to engage proactively with a tax profession well in advance of year-end to ensure compliance, minimize tax liabilities, and maximize the opportunities presented by this comprehensive legislation.

About Community CPA

Whether you choose to DIY it or hire a qualified professional, Community CPA is here to provide you with the knowledge you need to make informed decisions that protect your wealth and preserve your financial health.

We encourage you to explore our YouTube channel, where you will find valuable content related to a wide range of accounting and tax planning topics. We also host two weekly YouTube livestreams on Tuesdays and Saturdays, where you can learn directly from our accounting and tax planning experts.

If you would like to learn more about how Community CPA could help you, your family, or your business, please contact us using the brief form below.